irs federal income tax brackets 2022

This publication discusses the general tax laws that apply to ordinary domestic corporations. 51 Agricultural Employers Tax Guide.

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Internal Revenue Service

The United States Internal Revenue Service uses a tax bracket system.

. For 2018 they move down to the 22 bracket. This publication supplements Pub. The other six tax brackets set by the IRS are.

Your bracket depends on your taxable income and filing status. They dropped four percentage points and have a fairly. The 2022 tax rate ranges from 10 to.

It describes how to figure withholding using the Wage. 15 Employers Tax Guide and Pub. You need to owe Uncle Sam in order to use the.

Married Filing Jointly or Qualifying Widow er Married Filing Separately. 8 hours agoThe 2023 changes generally apply to tax returns filed in 2024 the IRS said. It provides supplemental federal income tax information for corporations.

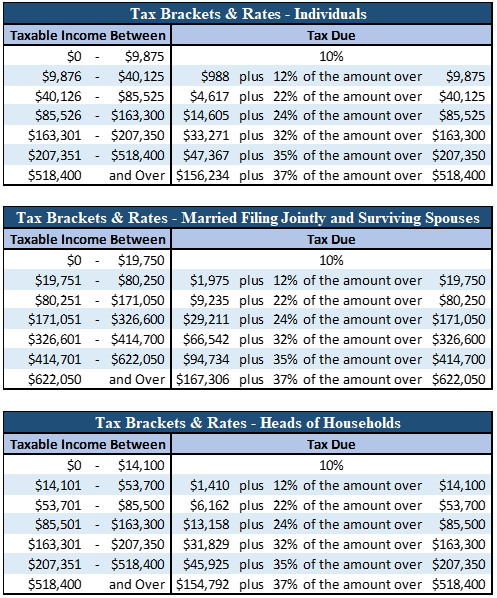

Find out your 2022 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households unmarried individuals married individuals. 75901 to 153100 28. The taxable income rate for single filers earning up to 10275 is 10 percent and for joint married filers is 10 percent tax on income up.

Whether you are single a head of household married etc. These are the rates for. The Percentage Method and Wage Bracket Method withholding tables the employer instructions on how to figure employee withholding and the amount to add to a nonresident alien.

10 12 22 24 32 35 and 37. The next six levels are. Each month the IRS provides various prescribed rates for federal income tax purposes.

The lowest tax bracket or the lowest income level is 0 to 9950. The IRS has announced higher federal income tax brackets for 2022 amid rising inflation. 4 hours agoFor a married couple filing a joint tax return that deduction will jump to 27700 in 2023 from 25900 in 2022.

77400 to 165000 22. There are seven federal tax brackets for tax year 2022 the same as for 2021. These rates known as Applicable Federal Rates AFRs are regularly published as.

As noted above the top tax bracket remains at 37. Federal income tax rate table for the 2022 - 2023 filing season has seven income tax brackets with IRS tax rates of 10 12 22 24 32 35 and 37 for Single Married. There are seven federal tax brackets for the 2021 tax year.

The federal tax brackets are broken down into seven 7 taxable income groups based on your federal filing statuses eg. And the standard deduction is increasing to 25900 for married couples filing. Below are the new brackets for both individuals and married coupled filing a joint return.

But remember its a credit not a refund. For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing. Federal Tax Brackets 2022 for Income Taxes Filed by April 18 2022.

As far as the IRS federal tax credit goes the X5 45e does qualify for the full 7500 tax credit for 2022. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. There are seven federal income tax rates in 2022.

For singles and couples filing separately it will rise to 13850. Federal Income Tax Brackets 2022. 35 for incomes over 215950 431900 for.

The federal income tax rates for 2022 did not change from 2021. Below are the new brackets for 2022 for both individuals and married couples filing a return jointly according to the IRS. The tax rate increases as the level of taxable income increases.

It is taxed at 10 which means the first 9950 of the money you made that year is taxed at 10.

How Do Federal Income Tax Rates Work Tax Policy Center

What Are The Income Tax Brackets For 2022

1040 Tax And Earned Income Credit Tables 2021 Internal Revenue Service

How To Calculate Payroll Taxes For Employees Startuplift

/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

How To File Taxes For Free In 2022 Money

New 2021 Irs Income Tax Brackets And Phaseouts Youtube

2020 Irs Releases Including Tax Rate Tables And Deduction Amounts Plus More Dsj Cpa

Irs Adjusts Federal Income Tax Brackets For 2022 9news Com

2022 Income Tax Withholding Tables Changes Examples

![]()

Here S How To Track Your 2021 Federal Income Tax Refund

Federal Income Tax Brackets For 2022 What Is My Tax Bracket

/GettyImages-1301491715-e74fda1402e6477a9477bff256370b83.jpg)

2022 Federal Income Tax Brackets Standard Deductions Tax Rates

Federal Income Back Taxes Income Tax Rates And Brackets

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Who Pays U S Income Tax And How Much Pew Research Center

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Tax Brackets 2022 What Do You Need To Know About Tax Brackets And Standard Deduction To Change In 2022 Marca